I have fond memories of my 1988 V8 90 County Station wagon that I bought new for £14k. Although horrific fuel consumption and rusted like a Lancia.View attachment 7899739

This was sold as a "County Station Wagon" back in 1989. Second only in expense to the Range Rover.

The Grenadier Forum

Register a free account today to become a member! Once signed in, you'll be able to contribute to the community by adding your own topics, posts, and connect with other members through your own private inbox! INEOS Agents, Dealers or Commercial vendors please use the contact us link at the bottom of the page.

-

Guest submit your best shot for a chance to win the December Photo Contest. Photo Contest Click Here

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Station wagon?

- Thread starter Vilhelm007

- Start date

In college, I fell in love with and purchased a 1959 Chevy Parkwood station wagon as my daily driver. Many good times!

To simplify, think of the Station Wagon (SW) as the "car".

We use it internally for build specifications because in other parts of the world to the US, there is also a Grenadier Utility Wagon (UW) 5 seater.

Whilst not entirely accurate, think of this as more of a "commercial vehicle". The only major difference is the rear bench of the UW 5 seater sits further forward (5-6 inches), allowing enough space for a euro pallet in the boot space.

In some EU countries this puts the vehicle into a different category and prevents some luxury car taxes etc. In the UK, even though the 5 seater UW doesn't fit all the tax criteria to be fully VAT reclaimable for most businesses, they still sit in a loophole segment meaning that yearly road fund license (or road tax) is currently substantially less than the SW.

Other UWs referred to internally include chassis-cab, any 2 seater variant (including the modified UK VAT reclaimable version) and the QM.

We use it internally for build specifications because in other parts of the world to the US, there is also a Grenadier Utility Wagon (UW) 5 seater.

Whilst not entirely accurate, think of this as more of a "commercial vehicle". The only major difference is the rear bench of the UW 5 seater sits further forward (5-6 inches), allowing enough space for a euro pallet in the boot space.

In some EU countries this puts the vehicle into a different category and prevents some luxury car taxes etc. In the UK, even though the 5 seater UW doesn't fit all the tax criteria to be fully VAT reclaimable for most businesses, they still sit in a loophole segment meaning that yearly road fund license (or road tax) is currently substantially less than the SW.

Other UWs referred to internally include chassis-cab, any 2 seater variant (including the modified UK VAT reclaimable version) and the QM.

That’s really helpful, Paddy.... I Am looking at the modified UK VAT reclaimable version of the 2-seater Utility Wagon, and I’m a bit unclear on eligibility. If I’m using it mainly for business but occasionally for personal errands (non-commute), would that muddy the waters when claiming VAT?

That’s really helpful, Paddy.... I Am looking at the modified UK VAT reclaimable version of the 2-seater Utility Wagon, and I’m a bit unclear on eligibility. If I’m using it mainly for business but occasionally for personal errands (non-commute), would that muddy the waters when claiming VAT?

No different from say a Transit van. VAT is reclaimable on purchase.

If you use for personal use there is a BIK charge for company employees, although this is unaffected if the personal use is insignificant.

In my eyes it has a ladder chassis and separate body which makes it a truck.

A Station Wagon to me is a large estate car.

A Station Wagon to me is a large estate car.

- Local time

- 8:15 AM

- Joined

- Dec 28, 2021

- Messages

- 1,165

HMRC assume everything is a car unless you can prove otherwise. The changes in the rules around double-cabs makes payload much more important.In my eyes it has a ladder chassis and separate body which makes it a truck.

A Station Wagon to me is a large estate car.

Why do they call the Grenadier a station wagon? The very words “station wagon”, almost makes me nauseous with horrible smells of cigarette smoke, and other sweaty gym odors, in a large wide vehicle with a wide rear window and a tailgate.

I will never refer to my beautiful Grenadier as that horrendous station wagon because it is not one! It is the most well made Utility Vehicle in existence

The body style is a station wagon. It just happens to be a station wagon on a truck chassis. Don't worry, it's in good company. Enjoy your station wagon.

Those aren’t station wagons. THIS IS A STATION WAGON!

HMRC assume everything is a car unless you can prove otherwise. The changes in the rules around double-cabs makes payload much more important.

Yeah they make (and change) the rules to suit themselves and to charge us more

overlanding.

Kidding aside, what we Americans think of as a station wagon is referred to as an estate car in the UK. I think that’s where some confusion comes in with this topic.

I just find the protest comically inane - it's like complaining that the brits call your hood a bonnet.Kidding aside, what we Americans think of as a station wagon is referred to as an estate car in the UK. I think that’s where some confusion comes in with this topic.

Last edited:

Its a two box passenger vehicle. your plate does not say "truck".

It's a station wagon, and not a very good one at that. The luggage compartment is extremely small, and due to the the retro boxyness, ladder frame, and 4wd, it's much less useful than a unibody 2wd for 99.99999% of the miles we are putting on our "wagons".

I think whats causing some people emotional distress is the station wagon was usually based on an adaptation of a 3box design car, and the term SUV, which was created by marketing departments, so as to not call something that is not a truck, a station wagon.

The last "truck" wagon as far as I know, was the 2013 GMC 3/4 ton with a factory payload of 2500lbs and a tow of 10000lbs. A rebody of the 3/4 ton GMC pickup truck.

Yes. We drive a pussymobile, like it or not.

It's a station wagon, and not a very good one at that. The luggage compartment is extremely small, and due to the the retro boxyness, ladder frame, and 4wd, it's much less useful than a unibody 2wd for 99.99999% of the miles we are putting on our "wagons".

I think whats causing some people emotional distress is the station wagon was usually based on an adaptation of a 3box design car, and the term SUV, which was created by marketing departments, so as to not call something that is not a truck, a station wagon.

The last "truck" wagon as far as I know, was the 2013 GMC 3/4 ton with a factory payload of 2500lbs and a tow of 10000lbs. A rebody of the 3/4 ton GMC pickup truck.

Yes. We drive a pussymobile, like it or not.

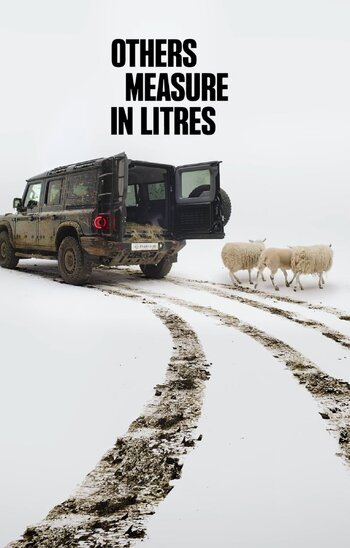

Grenadier spec’d to fit 2 sheep in cargo - “Wagon Queen Family Truckster” spec’d to fit 1 dead aunt on top

The term station wagon used to be common in the UK.Kidding aside, what we Americans think of as a station wagon is referred to as an estate car in the UK. I think that’s where some confusion comes in with this topic.

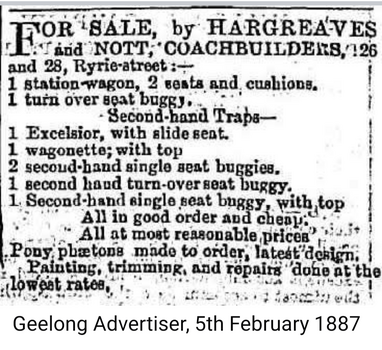

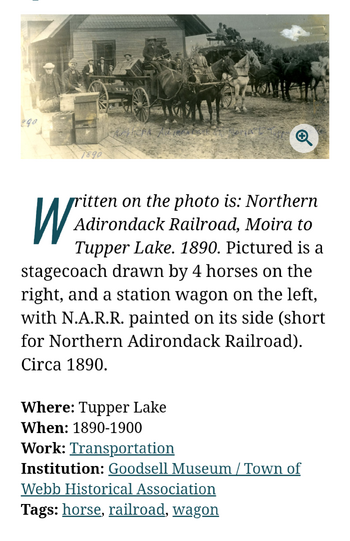

A couple of claims to the origin of the term from around the 1890's (Australia/New York)

I see they were running pizza cuttersThe term station wagon used to be common in the UK.

A couple of claims to the origin of the term from around the 1890's (Australia/New York)

View attachment 7901455View attachment 7901456

I think Landmann answered this perfectly.That’s really helpful, Paddy.... I Am looking at the modified UK VAT reclaimable version of the 2-seater Utility Wagon, and I’m a bit unclear on eligibility. If I’m using it mainly for business but occasionally for personal errands (non-commute), would that muddy the waters when claiming VAT?

I spent many years working within a large dealer group, predominantly with their Ford franchises. One thing our Transit Centre sales people were very good at was admitting they're not VAT or BIK experts (mostly to avoid liability!). Take everything you're told and read online into account, but check everything with the accountant you pay to submit your taxes.

As for the semantics of English vs. American, I have no strong opinion but very much enjoy the discussion.

I've not really thought much about the Station Wagon language because as said, its what the models are called internally and also externally with the various RV setters and data companies (e.g. ALG in USA, Jato, Solera, Redbook in AUS etc.)... because that's what info we give them.

My understanding was the term came from the UK where posh folk had a carriage/wagon to take them and their luggage from their estate to the train station. Maybe that's why in the UK it evolved it into "estate cars"?

My personal opinion is call it what you want, as the English bard said "What's in a name? That which we call a rose by any other name would smell as sweet."

But then (the American) Gertrude Stein said "a rose is a rose is a rose is a rose".

Wouldn't the world be boring if we all thought the same way.

Thanks so much for your reply, that really helped and answered exactly what I was wondering. Once again thank you..........No different from say a Transit van. VAT is reclaimable on purchase.

If you use for personal use there is a BIK charge for company employees, although this is unaffected if the personal use is insignificant.

Grenadier spec’d to fit 2 sheep in cargo - “Wagon Queen Family Truckster” spec’d to fit 1 dead aunt on top

View attachment 7901453

Attachments

Similar threads

- Replies

- 21

- Views

- 2K

- Replies

- 21

- Views

- 4K

- Replies

- 20

- Views

- 4K