The Grenadier Forum

Register a free account today to become a member! Once signed in, you'll be able to contribute to the community by adding your own topics, posts, and connect with other members through your own private inbox! INEOS Agents, Dealers or Commercial vendors please use the contact us link at the bottom of the page.

-

Guest submit your best shot for a chance to win the December Photo Contest. Photo Contest Click Here

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

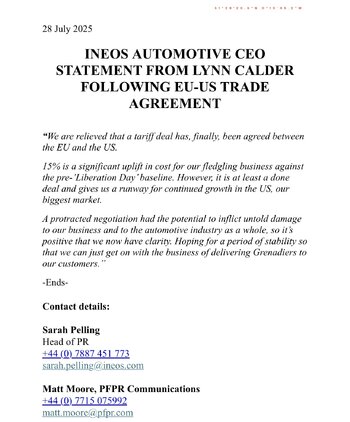

Official statement on US EU tariff deal

- Thread starter Baron von Teuchter

- Start date

If it’s Benz, RR, 911, people will pay more. For IG, sales are slow, really slow. As a lux SUV, generally, people don’t seem to want INEOS. As a rugged built tough SUV, people can’t afford it. They managed to put one foot on the train and the other on the platform….but the train is leaving.

Hence tha Arcane Works, etc. IA doesn't seem to want to change the bones of the vehicle (thankfully) but is making an effort to appease the "lux SUV" segment you mention. They'll probably have to go a little further than they have so far.

The 2024 numbers you cite are from two years of reservations and pre-orders and therefore not directly comparable.

Last edited:

Yes, they are and they don’t account for the delay due to seats but inventory on hand is high and not moving in our area. While there will be adjustments for each year it still doesn’t bode well for dealers tariffs won’t help the lux and just hurts the avg Joe 4x4 side even more.

hiiii .... It’s clear that VAT and tariffs work differently, and selling within the EU is simpler. For non-EU sales, the VAT doesn't apply, but tariffs do. If you need to quickly check VAT amounts or rates, Vatcalc.Onl can help simplify calculations.The announcement was that US cars can enter the European Union without a tariff. European cars receive 15% tariff when they enter the US.

Tax is something different. Sales to private customers (B2C) are always with tax, to companies providing a VAT number (B2B) without tax. Taxes vary between the countries. When I sell to Norway, for example, which is not part of the European Union, I need to check lists. There are products free of tax, while others are not.

The easy and short form is (but it can become more complicate):

Do I sell to a private EU citizen, I need to apply the German VAT tax (19%),

Do I sell to a company within the EU which provides a VAT ID I do not apply a VAT tax.

Do I sell to anybody not an EU citizen I do not apply a VAT tax.

A tariff is applied always and it has to be payed when entering the country to the local customs officials by the buyer. When I buy something in the UK I pay a tariff (which is as high as the VAT). As long as I sell a product, I have payed VAT for, to customers, I get the VAT I paid back from the tax office. I do not get back a tariff. That is just a simple explanation. In reality it is far more complicated. That's why I do most of my business within the EU. I only sell to the outside of the EU in special cases. However, the UK is different, there we have established delivery chains, so I regularly sell to the UK.

AWo

Similar threads

- Replies

- 5

- Views

- 554

- Article

- Replies

- 53

- Views

- 4K

- Replies

- 144

- Views

- 7K

- Replies

- 22

- Views

- 2K

- Replies

- 5

- Views

- 489