Hi everyone. I'm excited to be picking up my new Grenadier utility later this week, but I'm struggling a little with insurance. Like many in the UK, I'm would like to buy the vehicle through my business, in order to reclaim the VAT, but the insurance quote Ive had for that has been horrendous - £14k! That was through the broker Adrian Flux. Does anyone have any experience with company insurance on the Grenadier? If so, could you tell me who you use please? Many thanks.

The Grenadier Forum

Register a free account today to become a member! Once signed in, you'll be able to contribute to the community by adding your own topics, posts, and connect with other members through your own private inbox! INEOS Agents, Dealers or Commercial vendors please use the contact us link at the bottom of the page.

-

Guest submit your best shot for a chance to win the December Photo Contest. Photo Contest Click Here

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Imminent owner struggling with insurance

- Thread starter Animal3944

- Start date

Speak to your local NFU office. Use the telephone and your local office, rather than their call centre or by online. It's amazing what the human touch can do. If they ask for a Thatcham approved alarm, tell them you will install a scorpion tracker instead since it has a factory alarm fitted (but not Thatcham approved). The NFU have a partnership deal with Scorpion and you can buy a tracker quoting NFU for £199 and you will recover that plus a lifetime subscription in what you save in discount by having a tracker fitted.Hi everyone. I'm excited to be picking up my new Grenadier utility later this week, but I'm struggling a little with insurance. Like many in the UK, I'm would like to buy the vehicle through my business, in order to reclaim the VAT, but the insurance quote Ive had for that has been horrendous - £14k! That was through the broker Adrian Flux. Does anyone have any experience with company insurance on the Grenadier? If so, could you tell me who you use please? Many thanks.

I have the N1 commercial grenadier insured as a commercial vehicle with Aviva through our broker.Hi everyone. I'm excited to be picking up my new Grenadier utility later this week, but I'm struggling a little with insurance. Like many in the UK, I'm would like to buy the vehicle through my business, in order to reclaim the VAT, but the insurance quote Ive had for that has been horrendous - £14k! That was through the broker Adrian Flux. Does anyone have any experience with company insurance on the Grenadier? If so, could you tell me who you use please? Many thanks.

Unfortunately I can't tell you what it cost because it is part of a fleet policy with about 40 vehicles on it and I just get an overall invoice for the policy that is not broken down by vehicle - I know that it works out at about £2K per vehicle per annum if you just divide the premium by the number of vehicles - probably sounds high but most are Frozen HGV vehicles which do very high annual mileage and do a wicked amount of damage on the very odd occasions that they hit something.

Sou

Hats off to you, last time I was running an hgv fleet there was hardly a day when somebody didn't hit something.

Back on topic, NFU van department did a decent quote for me.

I have the N1 commercial grenadier insured as a commercial vehicle with Aviva through our broker.

Unfortunately I can't tell you what it cost because it is part of a fleet policy with about 40 vehicles on it and I just get an overall invoice for the policy that is not broken down by vehicle - I know that it works out at about £2K per vehicle per annum if you just divide the premium by the number of vehicles - probably sounds high but most are Frozen HGV vehicles which do very high annual mileage and do a wicked amount of damage on the very odd occasions that they hit something.

Hats off to you, last time I was running an hgv fleet there was hardly a day when somebody didn't hit something.

Back on topic, NFU van department did a decent quote for me.

- Local time

- 8:27 PM

- Joined

- Dec 28, 2021

- Messages

- 1,137

Don't use Adrian Flux; they seem to treat the Grenadier really badly.

Ask NFU Mutual, ring your local office and talk to them. (I'm not enjoying my claim with them, but that is not directly their fault. Claims are where insurance companies can actually make a difference).

Try the online comparison services, remembering that technically the Grenadier N1 is a van and the M1 is a car. My first years cover was with Admiral and comparitively cheap, (but that is not a recommendation, Admiral can be a pain to deal with).

Ask NFU Mutual, ring your local office and talk to them. (I'm not enjoying my claim with them, but that is not directly their fault. Claims are where insurance companies can actually make a difference).

Try the online comparison services, remembering that technically the Grenadier N1 is a van and the M1 is a car. My first years cover was with Admiral and comparitively cheap, (but that is not a recommendation, Admiral can be a pain to deal with).

I’m on business cover with NFU, I think its around the £700 mark… I had a fair bit of NCD though.

Got mine through direct Line - memory says around £500. Fieldmaster not commercial.

I am with LV @ around £550.00 Rural living, clean license, not young, etc, etc.

Adrian Flux definitely don't want your business. I have not as yet seen a competitive quote from them.

Strange thing is, I have my motorcycle via them, and at a good rate.

On here, judging by the various threads, it seems the following are definitely worth a call:

NFU

LV

Admiral

Zurich

Direct Line

Best of luck

Adrian Flux definitely don't want your business. I have not as yet seen a competitive quote from them.

Strange thing is, I have my motorcycle via them, and at a good rate.

On here, judging by the various threads, it seems the following are definitely worth a call:

NFU

LV

Admiral

Zurich

Direct Line

Best of luck

Direct Line had no issue with the vehicle being business-owned. They have my business-owned car and the IG (not business-owned) on a multi-policy

Thank you. That did the trick. NFU quoted £900. A massive difference.Speak to your local NFU office. Use the telephone and your local office, rather than their call centre or by online. It's amazing what the human touch can do. If they ask for a Thatcham approved alarm, tell them you will install a scorpion tracker instead since it has a factory alarm fitted (but not Thatcham approved). The NFU have a partnership deal with Scorpion and you can buy a tracker quoting NFU for £199 and you will recover that plus a lifetime subscription in what you save in discount by having a tracker fitted.

Just started reading this thread. I’m awaiting a 2 seater commercial through my company as a pool car. I tried AFlux 2 days ago. Value £88k for the Grenadier and ask for quote for a VW eTransporter. NO REPLY after going through the two which took ages. I rang them and they said can’t insured the eTransporter and £13,500 for Grenadier. Rang Admiral and they based the 2 seater as a van as no plate yet and sane for etransporter - no ncd’s £2000Hi everyone. I'm excited to be picking up my new Grenadier utility later this week, but I'm struggling a little with insurance. Like many in the UK, I'm would like to buy the vehicle through my business, in order to reclaim the VAT, but the insurance quote Ive had for that has been horrendous - £14k! That was through the broker Adrian Flux. Does anyone have any experience with company insurance on the Grenadier? If so, could you tell me who you use please? Many thanks.

Weird one. NFU. Insure my 992GT3 last 4yrs and my new Rubicon but when I rang them last month they said they wouldn’t insure the Grenadier as they wanted all my business to consider doing another vehicle. I used to have my 6 stores insured with them but their premiums shot up 3yrs ago so I left. Weird way to lose even more businessSou

Hats off to you, last time I was running an hgv fleet there was hardly a day when somebody didn't hit something.

Back on topic, NFU van department did a decent quote for me.

- Local time

- 8:27 PM

- Joined

- Dec 28, 2021

- Messages

- 1,137

NFU Mutual seem to be concentrating on farms and agricultural business risks and pricing other risks out.

As I work for a competitor, I'm not complaining but irritatingly my employer does not do simple motor insurance, so I have ended up with Hastings Direct on a telematics policy at under £800, notwithstanding I wrote my original Grenadier off by drowning it.

As I work for a competitor, I'm not complaining but irritatingly my employer does not do simple motor insurance, so I have ended up with Hastings Direct on a telematics policy at under £800, notwithstanding I wrote my original Grenadier off by drowning it.

LV proved competitive for me. SW highly specced for around £750.00

Direct Line. Came through for me

Last year was £860 odd, with Admiral.

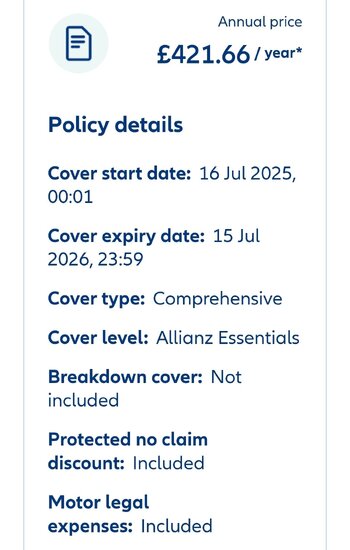

I was pleasantly surprised this year shopping around, so am switching to Allianz.

I'm in GU14 postcode, no points, my wife is a named driver with a single no fault claim. 10k miles a year, commuting etc.

I was pleasantly surprised this year shopping around, so am switching to Allianz.

I'm in GU14 postcode, no points, my wife is a named driver with a single no fault claim. 10k miles a year, commuting etc.

Attachments

Similar threads

- Replies

- 10

- Views

- 353

- Replies

- 2

- Views

- 232